Regional conference on correspondent banking inaugurated by EU Global Facility, Bank of Mauritius

Port Louis, 11 May 2022 – A regional conference on correspondent banking and de-risking in Eastern and Southern Africa was opened today by the EU Global Facility on AML/CFT and the Bank of Mauritius (BoM) in collaboration with the Eastern and Southern Africa Anti-Money Laundering Group (ESAAMLG).

Held under the title “From de-risking to best practices in correspondent banking relationships in Eastern and Southern Africa”, the two-day event aims to assess the causes and existence of de-risking in ESAAMLG countries, as well as measures to tackle financial inclusion through the sharing of best practices in correspondent banking.

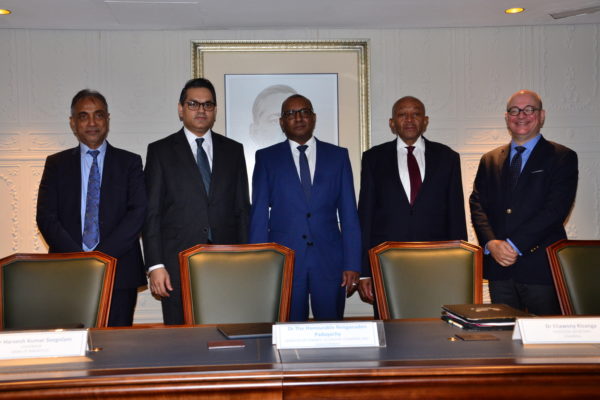

Minister of Finance, Economic Planning and Development, Dr. Renganaden Padayachy, opened the conference, stating: “Our objective is for Mauritius to continue to strengthen its role as an international financial centre for the region while promoting financial stability and inclusion in the country. I am confident that the discussions at this conference will provide guidance in this direction.”

The high level conference will witness the participation of representatives from some of the most important actors in the banking field, including the International Monetary Fund, the Wolfsberg Group, SWIFT, the Financial Action Task Force (FATF), the Egmont Group, Facebook Payments, as well as Mauritian financial institutions.

“The BoM works very closely with all its regulatees to ensure a continuous monitoring of developments on the front of correspondent banking and cross border payments. This workshop is therefore of paramount importance to come out better equipped in view of fostering stronger correspondent banking relationships,” said Harvesh Seegoolam, Governor of the BoM.

For his part, David Hotte, Team Leader of the EU Global Facility, explained: “The economic impact of de-risking can be devastating for countries around the world. They include difficulties in accessing international payment systems and foreign markets for trade, closure of operations by institutions, reduced scale of operations, and diminished financial performance and job losses.”

Noting that the number of correspondent banking terminations and restrictions had increased in the ESAAMLG region in recent years, he added: “with this unique and very high level conference, we intend to provide answers and solutions to the conclusions of the ESAAMLG survey on correspondent banking relationships.”

Last year, Mauritius was removed from both the FATF List of Countries subject to Increased Monitoring ahead of the FATF set timelines and the European Commission List of High-Risk Third Countries. This followed continuous efforts to strengthen the effectiveness of the country’s AML/CFT regime.

——-

The event took place in a hybrid format (onsite and online) in Mauritius, from 11th to 12th, May 2022.

The objectives of this conference are to assist participants on:

(a) The de-risking phenomenon in ESAAMLG region, causes, consequences, and main drivers of correspondent banking relationships (CBRs) termination

(b) The measurement of de-risking impact and of listing

(c) Describe the FATF (Recommendation 13) and EU best practices, cross-border correspondent relationships, as opposed to domestic relationships, that should prompt additional customer due diligence measures

(d) Clarify the role of SWIFT as global provider of secure financial messaging services, and give an overview of the correspondent banking system, SWIFT’s role and initiatives in financial crime compliance, and particularly in the ESAAMLG region

(e) The challenges faced by correspondent banks

(f) The practical roles, tools and solutions, available for supervisors to design and implement risk-based supervision strategies

(g) The practical expectations, from the Financial Intelligence Units in receiving, analysing, and disseminating suspicious transaction reports on correspondent banking, and from Law Enforcement agencies in conducting investigations on financial crime abusing correspondent banking relationships (typologies) and the relevant consequences

(h) Facilitating the exchange of experiences between similar competent authorities